Right now they want to convince the american people all the postal service is crappy and all this but as soon as you privatize the postal service what you're sending right now for for uh 50 something cents that it'll cost you three and four dollars this ain't crappy postal service that no matter where you live if you order something it comes right to your front door delivered by this this postal service that makes sure the elderly get their medicine and the small business owner can compete this postal service that uh employs more veterans than any other uh business in the united states this crappy postal service that we must protect because if we don't they'll put ourselves in a position to miss it when it's gone.

PDF editing your way

Complete or edit your usps trucking contracts anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export postal form 5397 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form 5397 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 5397 form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about Google Form 5397

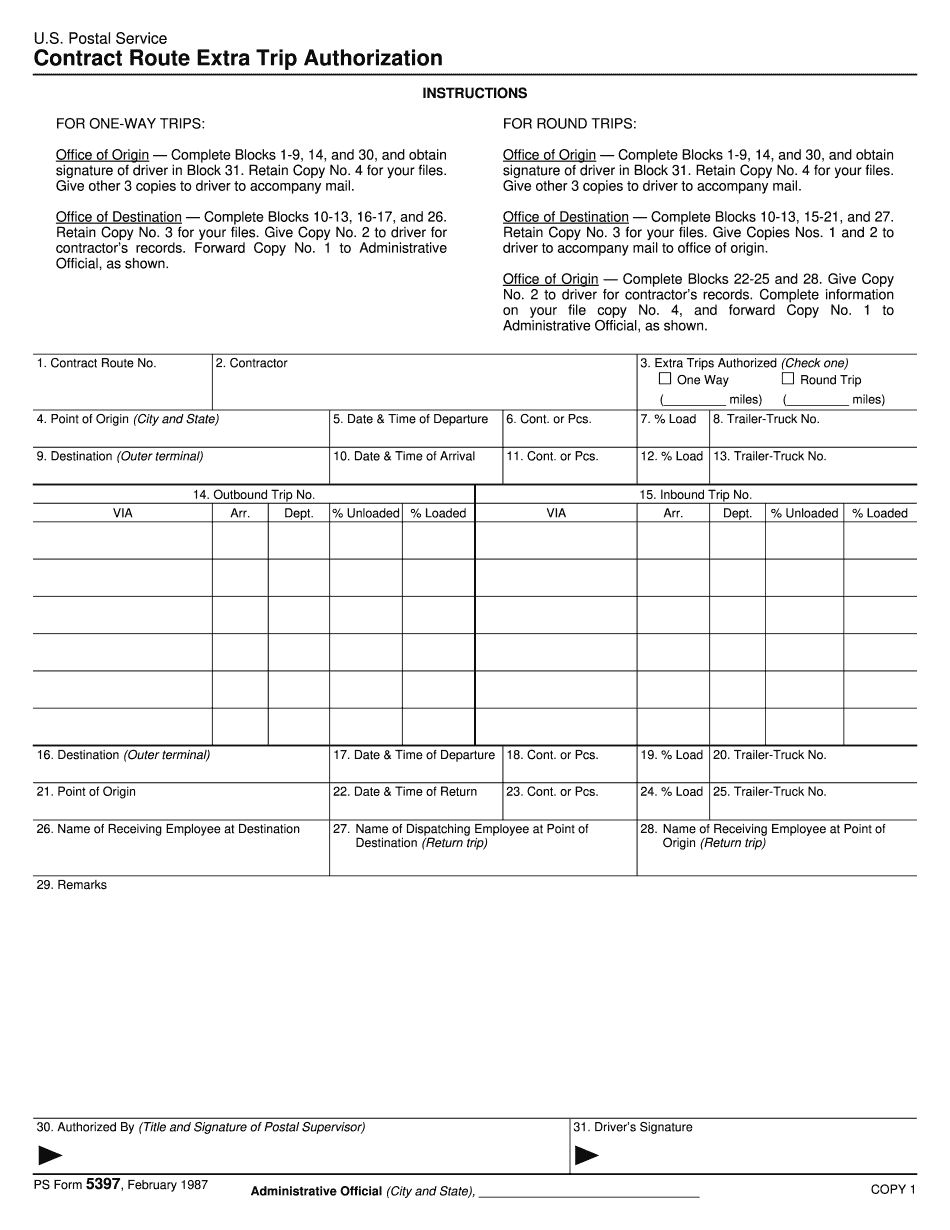

- PS Form 5397 is for one-way or round trip extra trips authorization.

- The form includes sections for Point of Origin, Date and Time of Departure, Load, Destination, Trailer-Truck No., and more.

- PS Form 5397 must be filled out accurately and in detail to authorize the extra trips.

Award-winning PDF software

How to prepare Google Form 5397

About Ps Form 5397

Ps Form 5397 is a form used by the U.S. Postal Service to authorize someone to act on the behalf of another person in regards to holding, forwarding, or returning their mail. It is also known as the "Application for Authorization to Hold Mail" form. Individuals who are planning to go on vacation or will be away from their home for an extended period of time can use this form to authorize a trusted person to hold their mail until their return. It can also be used by businesses or organizations to authorize someone to hold or forward their mail while they are closed or relocated. To complete the Ps Form 5397, the applicant must provide their personal information, details about the person being authorized to hold, forward, or return their mail, the period for which the authorization will be granted, and any other specific details related to their mail handling request. The completed form can be submitted to the local post office or online through the Postal Service's website.

How to complete a Google Form 5397

- 4 for your files

- Provide the other 3 copies to the driver to accompany the mail

- Then, move on to the 'Office of Destination' section and complete Blocks 1013, 1617, and 26

- Retain Copy No

- 3 for your files and give Copy No

- 2 to the driver for the contractor's records

- Finally, forward Copy No

- 1 to the Administrative Official as shown

- Complete each section accurately and thoroughly, following the instructions provided in the form description

People also ask about Google Form 5397

What people say about us

Complicated paperwork, simplified

Video instructions and help with filling out and completing Google Form 5397